The facts have remained the same. Over time (think 10, 15, or 20 years), stocks typically do better than bonds, and bonds typically do better than cash. Low expenses are typically a good sign of future relative performance. We also know that a diversified portfolio will help protect you from the variability of the stock market.

The facts have remained the same. Over time (think 10, 15, or 20 years), stocks typically do better than bonds, and bonds typically do better than cash. Low expenses are typically a good sign of future relative performance. We also know that a diversified portfolio will help protect you from the variability of the stock market.

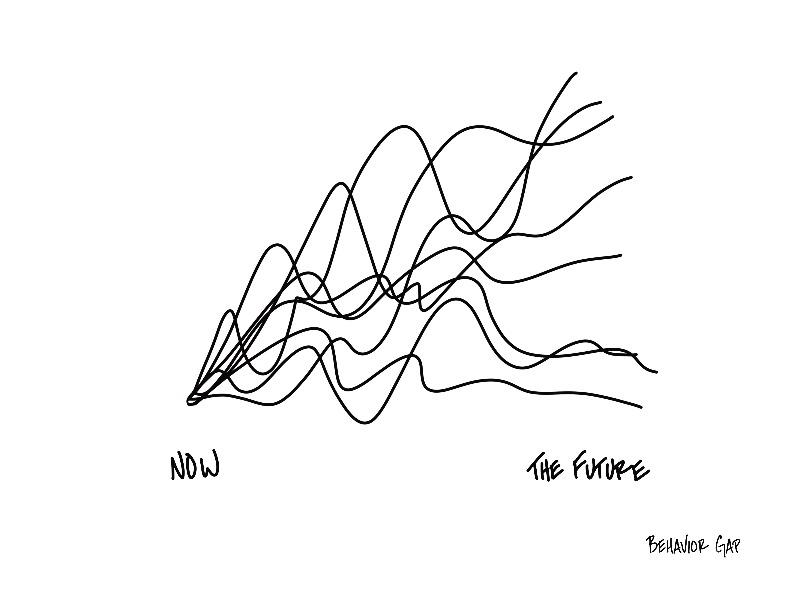

Read the entire article: Market forecasting isn’t like the weather… – Behavior Gap