4 Retirement Myths That You Need To Know

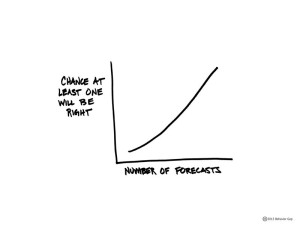

Financial Planning, Retirement Retirement planning is hard enough, but disinformation will get you sidetracked from your goal. You’ll need to know what’s not true before you start planning. There is a lot of fake news in the retirement saving world. The truth is, President Trump, Wall Street and GOP allies are making retirement planning more difficult. They are torching investor protection rules found in the Dodd-Frank Act and cutting state offerings for small business retirement plans. And that’s just what’s been happening in the firs

Retirement planning is hard enough, but disinformation will get you sidetracked from your goal. You’ll need to know what’s not true before you start planning. There is a lot of fake news in the retirement saving world. The truth is, President Trump, Wall Street and GOP allies are making retirement planning more difficult. They are torching investor protection rules found in the Dodd-Frank Act and cutting state offerings for small business retirement plans. And that’s just what’s been happening in the firs

Read the entire article: 4 Retirement Myths That You Need To Know

4 Retirement Myths That You Need To Know Read Post »