Economy Keeps Chugging Along Despite Negative Headlines | Zacks Investment Management Blog

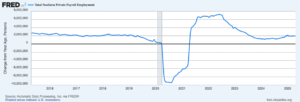

MarketsIn recent weeks, I have written extensively about tariff-induced economic uncertainty. Many analysts continue to call for a recession, and this past week the World Bank projected the U.S. economy would grow just 1.4% in 2025—down from 2.8% last year.

To be fair, I think concerns about rising input costs, inflation, business investment, and consumer spending are all valid and should be monitored closely in the coming months. But as I write, the reality on the ground looks quite different from the gloomy outlook that tends to play out in financial media.

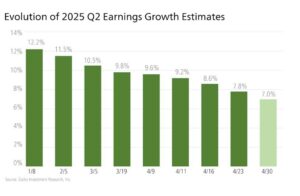

The U.S. economy has largely been resilient, with worst-case scenarios on tariffs avoided while economic fundamentals remain stable and strong. This combination has been driving the market rally, in my view.2

Read the entire article: Economy Keeps Chugging Along Despite Negative Headlines | Zacks Investment Management Blog