Young adults in the U.S. may be getting the message that saving for retirement is on their shoulders — they’re starting to put aside money for retirement years earlier than previous generations. That’s the good news. But when it comes to retirement saving in the U.S., there’s still plenty to worry about, too.

Young adults in the U.S. may be getting the message that saving for retirement is on their shoulders — they’re starting to put aside money for retirement years earlier than previous generations. That’s the good news. But when it comes to retirement saving in the U.S., there’s still plenty to worry about, too.

On the good-news front, Generation Y (currently ages 18 to 34) started saving for retirement at age 23, on average, according to a new survey of 1,000 U.S. investors, conducted by CoreData Research for Natixis Global Asset Management.

That’s six years earlier than Gen X (currently ages 35 to 50), who started saving at age 29 on average, and 10 years earlier than the boomer generation (currently ages 51 to 69), who started saving at age 33, according to the survey.

Where will technology be 30 years from now?

(2:09)

The CEOs of Google Ventures and XPRIZE share their predictions for the state of technology 30 years from now.

“That is a significant difference,” said Ed Farrington, executive vice president of retirement at Natixis Global Asset Management. “Time is one of the great allies when it comes to an investment plan. If you start earlier, you have to save a whole lot less and you wind up with a whole lot more — that’s the power of compounding.”

Their smarter savings strategy may be a result of Gen Y, also known as millennials, growing up at a time when the traditional pension was already all but dead, Farrington said. “They perhaps never heard of the promises of a defined-benefit plan or pension,” he said. “They’ve grown up in a world where … they have to put money away for themselves. This is not foreign to them.”

But savers aren’t confident, don’t know how much they need

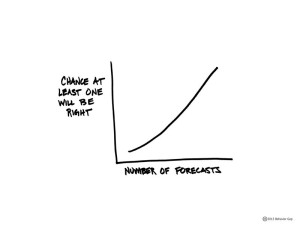

That said, there is still plenty of uncertainty among retirement savers of all ages. Only 50% of the survey respondents said they’re confident in their investing knowledge and abilities — and their fears appear well-founded. When asked how much money they could safely withdraw each year from a $1 million portfolio that needed to last for 30 years, 60% said 8% or more was a safe withdrawal rate. The safe withdrawal rate rule of thumb is closer to 4%. Read Is the 4% withdrawal rate right for you?.

Meanwhile, 47% of the survey respondents said they’re not sure how much money they need to save for retirement, and 54% of the survey respondents said they don’t believe their savings will provide enough retirement income. Read How much should you save for retirement?

When asked to pin down how much they need to save for retirement, Gen Yers said they need to save about $769,000, on average, and Gen Xers said $741,000. Boomers said they would need $946,000. Read Why you might be saving too much for retirement.

Getting savers on track

The survey also found that employers hold at least one key to improving the state of retirement savings in the U.S.: the power of the match.

Fully 74% of survey respondents cited their company’s 401(k) (or other defined-contribution plan) match as the reason for participating in their company-sponsored retirement plans.

And 50% of those have access to a workplace plan but don’t participate in it cited the lack of a match or said the match was too small, according to the survey.

“The plan sponsor has to make the plan as robust as possible, and then it’s up to the individual to participate, to understand it and to maximize it,” Farrington said, “so that when they get to that point in time [i.e., retirement] they’re prepared.”

Almost 70% of women said spending time with their grandchildren was a top retirement goal. Worried about your lack of retirement savings? Take solace from this: A majority of those who are already in retirement say it’s not as financially stressful as you may think, according to a new survey.

Almost 70% of women said spending time with their grandchildren was a top retirement goal. Worried about your lack of retirement savings? Take solace from this: A majority of those who are already in retirement say it’s not as financially stressful as you may think, according to a new survey.

Many people dream about what they would do all day if they didn’t have to go to work. The key is to

Many people dream about what they would do all day if they didn’t have to go to work. The key is to