Real Reason Brokers Oppose a Fiduciary Standard

PAULA DWYER

FEB 27, 2015

(Bloomberg) — Wall Street is wasting no time revving up its lobbying machine now that President Barack Obama has said his administration soon will propose a rule to require brokers to act as fiduciaries when advising clients on their retirement savings.

Asking brokers to put clients’ interests ahead of their own seems like a good idea, yet industry trade groups argue the rule will make investment advice and retirement planning too expensive for low- to middle-income families. If that happened, the argument goes, those families would save less for retirement and, down the road, could be a burden on taxpayers.

One industry group, the National Association of Plan Advisors, which represents professional retirement-plan advisers, goes so far as to call the proposal the “No Advice” rule.

This sounds alarming! Is Obama about to make worse the very problem — too little retirement savings — he says he wants to fix?

That’s the thrust of a memo written by the law firm Debevoise & Plimpton for the Financial Services Roundtable, which represents the chief executive officers of banks, insurers and asset managers. The main evidence comes from a 2011 study by consulting firm Oliver Wyman, which has come to represent the core of the industry’s argument.

That study says lower-income investors prefer to work with brokers (who don’t have a fiduciary duty and are paid through sales commissions, revenue-sharing deals and other fees) over registered investment advisers (who are paid directly out of a client’s pocket and already must put client interests ahead of their own).

Read more via Real Reason Brokers Oppose a Fiduciary Standard | Financial Planning.

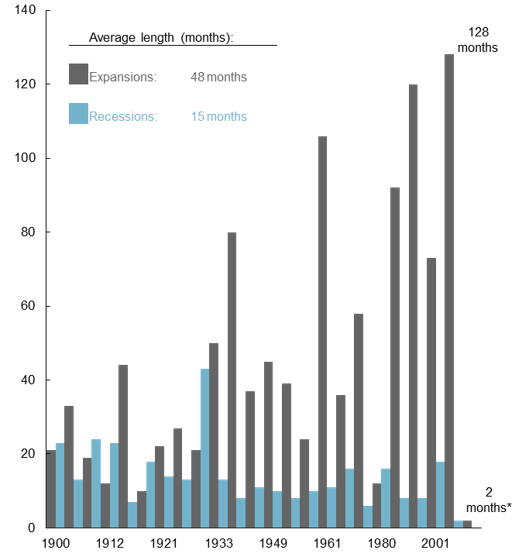

Last month, the Business Cycle Dating Committee of the National Bureau of Economic Research—the “scorekeepers” of economic recessions and expansions in the U.S.—marked the peak month of the previous expansion in February 2020, officially marking an end to the longest expansion on record (128 months) dating back to 1854.

Last month, the Business Cycle Dating Committee of the National Bureau of Economic Research—the “scorekeepers” of economic recessions and expansions in the U.S.—marked the peak month of the previous expansion in February 2020, officially marking an end to the longest expansion on record (128 months) dating back to 1854.