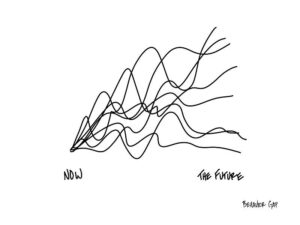

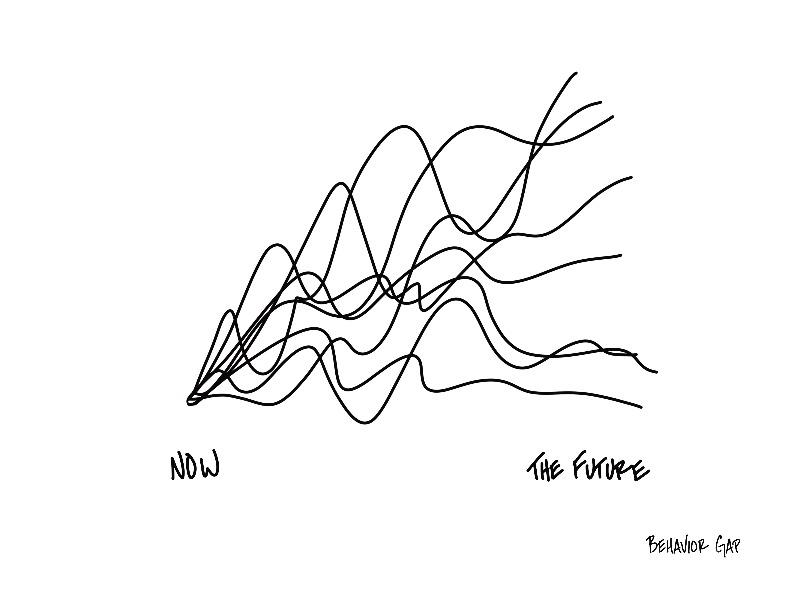

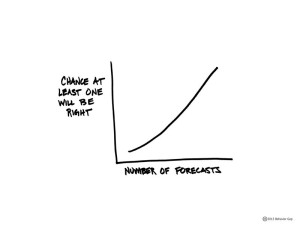

I used to make market comments quite frequently, but I don’t so much these days. It’s not that I no longer have an interest; I do still find the markets quite fascinating. It’s more that I’ve come to the conclusion that it makes no difference what I think: The markets will do what they do despite my opinion.

I used to make market comments quite frequently, but I don’t so much these days. It’s not that I no longer have an interest; I do still find the markets quite fascinating. It’s more that I’ve come to the conclusion that it makes no difference what I think: The markets will do what they do despite my opinion.

But when we’re faced with the rare situation when it looks like small minds are beginning to rule the day, I can’t resist stepping in to try to come to the rescue of those of us who wish to think bigger… globally… and long-term.

So first, let’s talk about the market facts: Yep, we’ve had a couple of lousy weeks in the market. So lousy in fact that the stock market (S&P 500 Index) is now basically unchanged from Thanksgiving of 2014. It’s so boring that the 3 month, 6 month and year-to-date returns are almost not measurable, leaving us with a less than a 1% total return overall since last fall.

What does this mean? Nothing. It’s a flat spot, which is a typical thing in the market from time to time. Sometimes we can get into these ruts for an extended period of time. Most likely, we’re just working off past excesses: The stock market gets a little ahead of itself from time to time and now it is taking a necessary breather. (Yawn here.)

The silver lining here is that a wicked sell off is also a great way to work off excess market valuations. Believe me, flat spots (consolidations) are a much easier way to digest past gains, unless you’re afraid of being bored to death.

The bottom line is that even with the past few weeks selloff, the current long-term uptrend is still intact. We’re still invested in equities in a meaningful way. If it changes in the future, we’ll step away from the stock market before bad turns to worse… and probably write about that too.

Second, let’s talk about Greece: Oh my. What a great story for the news channels. Although the story makes for great press, everyone has known for about 5 years that Greece is in trouble. If the market’s don’t like surprises and this is no surprise, then it’s no wonder that we haven’t seen much, if any market movement due to the newest leg of this crisis.

As I write this, it’s projected that Greek voters have voted “no” on furthering the bailout terms. It’s hard to say how the market will react, if at all. Greece is about 2% of the Eurozone and their GDP is about the same as Connecticut’s.

Although there won’t be a significant actual financial fallout, there could be some emotional, ‘what-if’ reaction. It could inject some volatility into financial markets in the coming weeks. If it’s enough to change the long-term trend of the US stock markets, we’ll adjust. Otherwise, we’ll take the media’s squawking with our usual grain of salt.

If you want to take action on the Greek crisis, I suggest that you take a European vacation. Everything that is Euro-based is cheaper. Stay in a nicer hotel in Munich or dine at a nicer restaurant in Paris. (Maybe stay away from Greece itself right now unless you have plenty of cash on hand, since the ATMs are only giving up about 60 Euros a day.)

And lastly, here are a couple of paragraphs from a recent interview with Aby Rosen (New York real estate tycoon):

More than 5 Billion was spent by rich Chinese investors on New York property between early 2013 and December 2014 – up from less than 300 million in 2012 – according to the Wall Street Journal. There are so many billionaires created in China on a monthly basis who are smart enough to know that taking money out of China is already profit in itself.

There are hundreds and hundreds, thousands and thousands of foreign investors wanting to spend their money in the U.S. There’s been a flight from South America, from Russians who want to take their money out of the country -the rouble’s collapse didn’t help lately but there is still enough money. There are Indians, Malaysians and Old Europeans, including Jews leaving France. Qatar is coming, Abu Dhabi is coming, Egyptians, people who made money in Africa. Lots of wealthy independent people are looking at America for second or third homes – and the US is far more welcoming now to foreigners than it ever has been.

Commerce is in. If real estate is booming, art is booming. If you have a great apartment, you need great art. The worlds of architecture, art and fashion are all melting together into one happy family. There’s so much money out there and people want to have a good time. What else are they going to do with their cash?

And of course, it’s not just real estate and art. The kinds of demographic moves Mr. Rosen is seeing will affect everything and everyone. Even you.

Jeff